Meta Platforms:Quarterly Results/2025 Q2

Return to: Earnings Season

See also: Meta Platforms Valuation Model | Meta Platforms:Quarterly Results/2025 Q1 | Meta Platforms:Quarterly Results/2024 Q4 | Meta Platforms:Quarterly Results/2024 Q3 | Meta Platforms:Quarterly Results/2024 Q2 | Meta Platforms:Quarterly Results/2024 Q1

Return to: Discussions

Q2 2025 Earnings Call Summary

Q2 2025 Earnings Call | Q2 2025 Earnings Call Transcript

Artificial Intelligence

Superintelligence

- Zuckerberg said they have begun to see glimpse of AI improving themselves, giving way to development of superintelligence.

- Zuckerberg said Meta's vision is to bring superintelligence to everyone.

- Zuckerberg said they are making progress on Llama 4.1 and 4.2 and they are working on next generation of models that will push frontier of AI.

- Zuckerberg pointed out that they are making investments because they believe superintelligence "is going to improve every aspect of what we do".

- Zuckerberg said he has gotten a little bit more convinced that a small team is the optimal setup for driving frontier research on Superintelligence (Q&A).

Core AI impact on core business

- Zuckerberg said the strong performance this quarter was mainly due to AI. "On advertising, the strong performance this quarter is largely thanks to AI unlocking greater efficiency and gains across our ads system."

- Zuckerberg said they expanded their "new AI-powered recommendation model for ads to new surfaces and improved its performance by using more signals and a longer context." This led to 5% increased in ad conversions in Instagram and 3% on Facebook.

- Zuckerberg said they are seeing good progress with AI for ad creative, with a meaningful percent of ad revenue coming from campaigns using Generative AI tools.

- Zuckerberg said advancements in recommendation systems have increased time spent on Facebook by 5% and 6% on Instagram.

- Zuckerberg said they are starting to see how they can deploy Business AI Agents in a number of countries and they are integrating it into ads on Facebook and Instagram as well as e-commerce websites.

- Incorporation of LLMs on Threads recommendation system is now driving a meaningful share of time spent on Threads.

- They are exploring how they can incorporate LLMs on other apps.

- Enhancements made to Andromeda model in Q2 drove around 4% increase in conversions on Facebook mobile Feed and Reels.

- Enhancements made to GEM increased ad conversions by around 5% on Instagram and 3% on Facebook Feed and Reels in Q2.

- They began deploying Lattice to earlier stage ads ranking models in April and this led to a 4% increase in ad conversions on Facebook Feed and Reels in Q2.

- Around 2 million Advantage+ advertisers are now using video generation features - Image Animation and Video Expansion.

- Zuckerberg said Meta teams are starting to use Llama 4 to build autonomous AI agents that will help to improve Facebook Algorithm to increase quality and engagement (Q&A). It's still a small step but the trajectory is optimistic.

Open-sourcing AI

- Zuckerberg said he doesn't think their thinking on open-sourcing has changed much (Q&A).

- Zuckerberg said they have always open-sourced some of their models and not all of them (Q&A).

- Zuckerberg expects that they will continue sharing leading models except models that are too big or carry security risks (Q&A).

Meta AI

- Zuckerberg reiterated that Meta AI has more than one billion monthly actives.

- Zuckerberg expect improvement in the LLM models to improve engagement in Meta AI.

- WhatsApp continues to be the largest driver of queries in Meta AI.

AI Devices

- Zuckerberg said they continue to see strong momentum with Ray-Ban Meta glasses.

- The performance AI glasses they are launching with Oakley Meta HSTNs will have longer battery life, higher resolution camera, and are designed for sports.

- The percent of users using Meta AI is growing and they are seeing increased AI retention as well.

- Zuckerberg said he thinks AI glasses will be the main way they will integrate superintelligence into people's lives.

- Demand for Ray-Ban Meta glasses still outstrips supply for the most popular SKUs.

Reality Labs

- Zuckerberg said they are seeing more people spend time with Quest ecosystem and the community is growing.

Q2 2025 Results

Expenses

- Cost of revenue rose 16%, driven by increased infrastructure costs and payment to partners, offset by increased useful life of servers.

- R&D increased 23%, driven by increased infrastructure costs and employee compensation.

- G&A fell 27%, driven by lower legal-related costs.

Ad performance

- Online commerce vertical was the largest contributor to y/y growth in ad revenue.

- Ad revenue growth was strongest in Europe (+24%) and Rest of World (+23%), followed by North America (+21%) and Asia-Pacific (+18%).

- 11% growth in ad impressions was mainly driven by Asia-Pacific.

- 9% growth in ad price benefited from strong ad demand, largely driven by improved ad performance.

- Pricing decelerated from 10% in Q1 to 9% in Q2 due to accelerated impression in Q2.

Engagement

- In Q2, Instagram video time was up 50% y/y globally.

- Facebook video time spent in the US grew 20% y/y in Q2.

- On Instagram, two-thirds of recommended content in the US now comes from original posts.

WhatsApp monetization

- CFO Susan Li said they expect the introduction of ads in Status will be gradual this year and next year, with low levels of ads initially.

- Li said they expect WhatsApp ads to fetch lower ad price than Facebook and Instagram for the foreseeable future given that WhatsApp is skewed towards lower monetization regions and limited data for ad tracking.

- As such, they don't expect WhatsApp to be a meaningful contributor of revenue growth for the next few years.

Business messaging

- Click-to-message revenue in the US grew more than 40% in Q2, driven by ramp in adoption of Website to Message ads.

Outlook

- The new U.S. tax law will lead to reduction in the US tax rate in the remainder of the year and future years.

- 2025 tax rate will be higher than Q2 tax rate.

- Li said infrastructure will be single largest contributor to 2026 expense growth (Q&A).

- Li said they expect CapEx to be in short-lived assets in 2025 and 2026 than it has been in prior years (Q&A).

- Analyst Doug Anmuth with JPMorgan said in the call that Susan Li's comments suggest CapEx of $100 billion in 2026. Li didn't deny it while Zuckerberg agreed that the investment they are making is massive (Q&A).

- Li said they expect to finance a large part of the CapEx themselves but they are also looking to include external financing (Q&A).

- Li said servers will be the biggest bulk of CapEx (Q&A).

ROI on investments

- Li said they continue to see strong ROI on their CapEx spend on the core AI side (Q&A).

- Li said they don't expect Gen AI work to be a meaningful driver of revenue this year or next year (Q&A).

Management guidance and analysts' estimates

Management guidance

| Key Items[1] | Q2 2025 | 2025 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Lower-point | Y/Y | Mid-point | Y/Y | Upper-point | Y/Y | Lower-point | Y/Y | Mid-point | Y/Y | Upper-point | Y/Y | |

| Revenue | $42.5 billion | 8.78% | $44.0 billion | 12.62% | $45.5 billion | 16.45% | ||||||

| Total expenses | $113 billion | 18.8% | $115.5 billion | 21.4% | $118 billion | 24.05% | ||||||

| Capital expenditure | $64 billion | 63.14% | $68 billion | 73.34% | $72 billion | 83.53% | ||||||

- Management's guidance assumes foreign exchange tailwind on revenue of 1% year-over-year in Q2 2025.

- Management expects full year tax rate to be in the range of 12-15%

- They expect to make changes to their ad model in Q3 2025 due to the EU DMA. These changes are expected to significantly impact revenue from Q3 2025.

Analysts estimates

| Key Items | Q2 2025 | Y/Y | Q3 2025 | Y/Y | 2025 | Y/Y |

|---|---|---|---|---|---|---|

| Revenue[2] | $44.79 billion | 14.65% | $44.62 billion | 13.87% | $188.45 billion | 14.56% |

| EPS[3] | $5.89 | 14.14% | $6.00 | -0.50% | $25.87 billion | 8.42% |

| Family Daily Active People | ||||||

| Ad revenue | ||||||

| Capex | ||||||

| Revenue- Reality Labs | ||||||

| Reality Labs operating loss | ||||||

| Operating margin | ||||||

| Ad impressions | ||||||

| Average price per ad |

Earnings revisions at Seeking Alpha in the last three months

Analysts opinions and insights

Ad checks were positive during the quarter

- Deutsche Bank research indicates that ad spend on Meta grew 1% quarter-over-quarter in Q2, and there is a trend for further acceleration in Q3. It added that industry spending remains strong overall.

- Buy, $655->$855: Stifel analyst Mark Kelley said April was slow initially when it come to ad spend but there has been improvement, with June being the best month in the quarter.

- Buy, $803: Citi said it expects Meta to report better than expected earnings for Q2 since online advertising environment is strengthening.

- Buy, $765->$775: Bofa said their advertising channel checks indicate improving ad spend since April.

- Overweight, $735->$795: JP Morgan said the updated price targets reflect better channel checks and favorable currency moves.

- Buy, $620->$740: Roth Capital said they have a positive bias towards the broader ad ecosystem as we approach Q2 earnings season.

- TD Cowen said their Q2 digital advertising expert check showed accelerating spend growth across Meta Platforms.

- Overweight, $664->$783: Wells Fargo said ad checks are healthy.

- Underperform->Hold: Needham said channel checks are driving upside to Meta's estimates.

- Overweight, $808: Piper Sandler said their channel checks for Meta were the "best in the group".

- Outperform, $665->$775: Oppenheimer said advertising environment has improved and they expect digital advertising growth of 10% and 12% in 2025 and 2026 respectively.

Macro and tariff uncertainty has eased

- Roth Capital believes easing macro and tariff uncertainty is reflected in Meta's current valuation.

- Overweight, $664->$783: Wells Fargo said it is raising estimates due to temporary tariff reprieve.

- Buy, $640->$800: Benchmark analyst Mark Zgutowicz said e-commerce trends are steady.

Analysts expects Meta to report solid results for Q2

- Buy, $700->$800: TD Cowen expects Meta to beat Q2 consensus estimates and projects revenue growth of 16% y/y, 2% above the expectations due to continued video monetization and engagement.

- Stifel analyst Mark Kelley expects upside second-quarter figures and slightly better guidance.

AI spending is a positive sign of revenue trajectory

- Bofa said Zuckerberg's comments that Meta will spend hundreds of billions on AI infrastructure is a positive sign of revenue trajectory.

Analysts welcomed Meta's recent product launches

- Outperform, $635->$740: Baird said (July 02) recent product launches across WhatsApp and Messenger represents an "important step" to unlock incremental revenue. It estimates click-to-message (CTM) ads are approaching $15-20 billion run rate while WhatsApp ads could bring in additional $10 billion over many years. They estimate additional subscriptions and fees could bring in another $10 billion, creating total messaging monetization opportunity of $40-$50 billion by 2030.

- Overweight, $664: Wells Fargo sees (June 17) WhatsApp ads bringing in $6 billion in additional revenue. They expect WhatsApp to finally achieve cost-per-thousand impressions (CPMs) and ad load as those seen in Instagram.

- Roth Capital said Meta's product roadmap and WhatsApp monetization traction in Q3 guide could be incremental positives.

- Buy, $825->$850: Analyst Maria Ripps of Canaccord said Reels, Shopping, and Overlay ads continue to attract ad dollars from DIP clients. She said Reels's tailwind could subside in 2026 but the introduction of ads on WhatsApp as well as its Business AI offering could help bridge the gap.

- Stifel analyst Mark Kelley said early feedback on WhatsApp monetization is positive. He said some market participants expect a fourth-quarter ramp-up in WhatsApp monetization.

- New Street Research analyst Dan Salmon projects that generative AI creative tools could increase Meta's ad revenue growth by 1% to 2% over the next several years and provide a 4% tailwind to ad revenue by 2030. That is an increase in ad revenue by $28 billion.

Meta stands to benefit from AI but there's short-term drag on earnings

- Analyst Maria Ripps of Canaccord said their expert thinks Meta's Business AI offering could drive 10%-20% improvement in Meta's ROAS.

- Buy, $683->$812: UBS pointed out (June 26) that potential revenue from AI initiatives such as Business Messaging and Meta AI are not yet reflected in analysts estimates. They added that a potential slowdown in AI monetization will not materially impact Meta since it primarily uses its own technology.

- Needham believes Meta's AI strategy "wastes capital and adds risks" and believes its margins and free cash flow are under structural downward trend.

- Oppenheimer projects Meta's CapEx to come in at $68 billion and $85 billion in 2025 and 2026, respectively.

Usage of Meta Platforms is rebounding, aided by AI

Deutsche Bank research found that usage of Meta Platforms is rebounding, aided by AI:

- Facebook: Facebook's global conversation count declined 5% year-over-year, an improvement from the 7% drop in the first quarter. Total user time spent also fell 3% year-over-year, better than the 6% decrease recorded in Q1.

- Instagram's global conversation count rose 4% year-over-year, a notable improvement from flat growth in the first quarter. Total time spent by users increased 11% year-over-year, well above the 6% growth seen in Q1.

Competitor expectations and results

Omnicom Group

- Omnicom's Q2 2025 revenue rose 3% y/y to $4.02 billion, in line with analysts estimate of $3.96 billion, driven by media and advertising revenue which rose 8.2% y/y to $2.29 billion.

- Media and advertising revenue accounted for 57.1% of Omnicom's Q2 2025 revenue. Strongest performance was seen in the media segment (segment associated with ad buying).

Publicis

- Publicis Q2 2025 organic net revenue rose 5.9% y/y to €3,617 million, exceeding 4.6% growth forecast. As a result, it raised its full year organic net growth guidance to 5% from a range of 4% to 5%. “We did not see any deterioration among our customers between the first and second quarters,” CEO Arthur Sadoun said. “The feeling of uncertainty is still there, but it has not materialized in cuts that could have had a real impact on our organic growth.”

- Around two-thirds of Publicis revenue comes from advertising-related activities.

Alphabet

Management guidance

- Alphabet is guiding CapEx spending of $75 billion in 2025.

Analysts estimates

| Key items[4] | Q2 2025 | Y/Y |

|---|---|---|

| Revenue | $94.0 billion | 11% |

| Advertising revenue | $69.6 billion | 7.7% |

| EPS | $2.17 | 15% |

| Google Cloud revenue | $13.12 billion | 27% |

Advertising spend and pricing insights

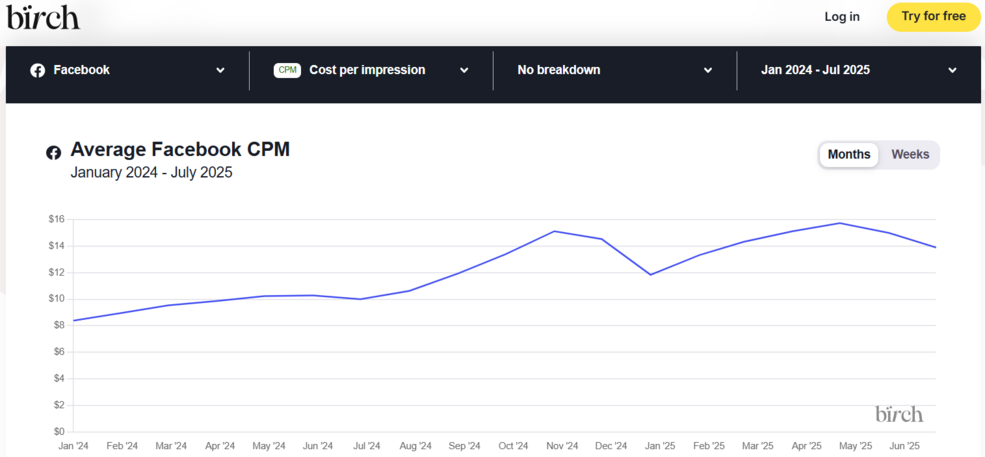

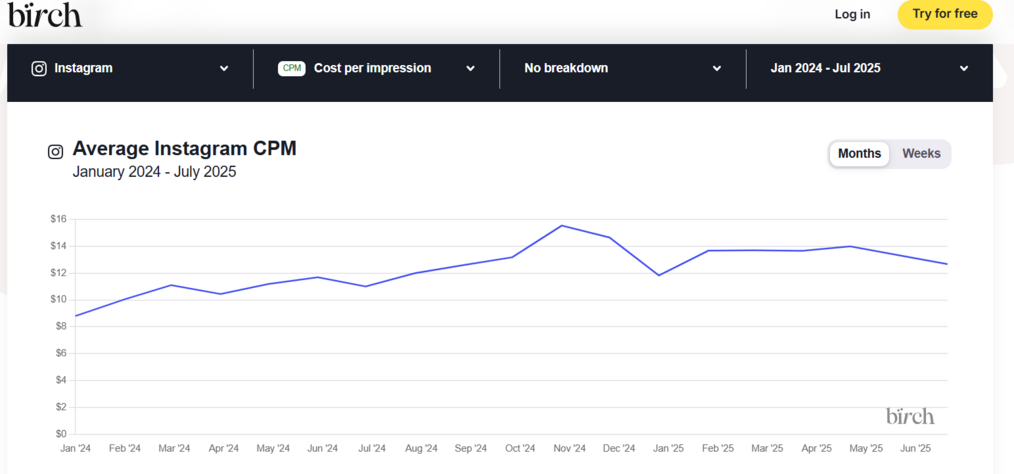

- Birch (formely Revealbot) data indicates Instagram CPM rose 35% y/y to $13.66.

- Similarly, the data indicates that Facebook CPM was up by around 38% y/y to $15.28.