Meta Platforms:Quarterly Results/2025 Q1

Return to: Earnings Season

See also: Meta Platforms Valuation Model | Meta Platforms:Quarterly Results/2024 Q4 | Meta Platforms:Quarterly Results/2024 Q3 | Meta Platforms:Quarterly Results/2024 Q2 | Meta Platforms:Quarterly Results/2024 Q1

Return to: Discussions

Q1 2025 Meta Earnings Call Summary

See: Q1 2025 Earnings Call | Q1 2025 Earnings Call Transcript

Macro uncertainty

- CEO Mark Zuckerberg said the business is performing very well and thinks that they are well positioned to navigate macro uncertainty. "Our business is also performing very well, and I think we're well-positioned to navigate the macroeconomic uncertainty," he said.

- CFO Susan Li said there is uncertainty but the $3 billion in their guidance range aims to factor it. "On the Q2 guide, there is uncertainty, obviously, on how the macro environment will evolve over time and how that could impact different segments of our business. Our Q2 revenue outlook aims to factor that in and partly -- that's partly why the $3 billion range reflects the potential for a wider range of outcomes," she said. (Q&A).

- Li said they have started seeing reduced ad spend in the US from Asia-based advertisers in anticipation of de minimis rule going away in May 2nd. "We have seen some reduced spend in the US from Asia-based e-commerce exporters, which we believe is in anticipation of the de minimis exemption going away on May 2nd. A portion of that spend has been redirected to other markets, but overall spend for those advertisers is below the levels prior to April. But our Q2 outlook reflects the trends we're seeing so far in April, which have generally been healthy. So it's very early and hard to know how things will play out over the quarter, and certainly harder to know that for the rest of the year." (Q&A).

DMA risk

- Li said it's too early to say what the changes caused by the DMA will be since they are in the process of engaging with the EU Commission. "It is really too early to speak about what those changes could be because we are in the process of engaging with the European Commission. I think maybe the most useful sort of metric I could give you is just that our advertising revenue in the European economic area in Switzerland, which would be the geographies impacted here, was 16% of our worldwide total revenue in 2024. Again, we are continuing to engage actively with the European Commission further on this. So we hope to have more clarity by next quarter's call." (Q&A).

CapEx and OpEx

- Li said majority of their CapEx this year will go to both generative AI and core business, with the majority going to the core business.

- Li said they continue to deploy CapEx in a way that grants them the maximum flexibility to react to technology and industry developments.

- Li said even with the capacity they are bringing in 2025, they are having a hard time meeting the compute demands across the company.

- Li said the higher infrastructure cost they expect this year is driven by tariff uncertainty (Q&A).

- Li said the are funding the Llama training and don't expect this will change (i.e. find a partner).

- Li said their updated OpEx guidance reflects their updated expectations for employee compensation as well as non-headcount related expenses. "The lowered outlook reflects more refined forecasts, including updated expectations for both employee compensation as well as some other non-headcount-related operating expenses this year. And that's partially offset by higher expected infrastructure costs related to our increased CapEx outlook as well as higher expected Reality Labs cost of goods sold," she said (Q&A).

- Li said the capacity situation is dynamic, making it hard to project where demand and supply will be (Q&A).

- Li said it's too early to discuss the 2026 CapEx, reiterating that the CapEx situation is dynamic and they continue to find a lot of good use cases to put "capacity toward our core AI ranking and recommendations work." (Q&A).

Artificial Intelligence (AI)

Llama 4 and Meta AI

- Zuckerberg said that in building Llama 4, they focused on low latency and context window. Low latency will aid voice conversation while context window will help in their personalization efforts. High context window will incorporate all the background that a user has shared across Meta Apps. (Q&A)

- Zuckerberg said the reason they want to build Llama out is because they want to control their own destiny by not depending on another company for something that is critical. They also want to be able to optimize it based on their user cases. (Q&A)

- Zuckerberg said they cannot do distillation from other closed models. (Q&A)

- Li said Meta continues to see the biggest usage in WhatsApp followed by Facebook.

- Zuckerberg said the standalone Meta AI app will serve some people who want to use it outside an app like WhatsApp. It will also be particularly important in the US where they have a low number of WhatsApp users. (Q&A).

AI opportunities

- Zuckerberg said AI opportunities they are seeing today include; improved advertising, more engaging experiences, business engaging experiences, business messaging, Meta AI and AI devices.

- Zuckerberg said even with the significant AI investments, they don't have to succeed in all the AI bets to have a good ROI, but if they do, it will be a great achievement.

- Zuckerberg said he thinks an increase in productivity from AI will likely make advertising a larger share of ad spend. "I think that the increased productivity from AI will make advertising a meaningfully larger share of global GDP than it is today," he said.

- Zuckerberg said AI will help create better content, in the form of videos and photos.

- Zuckerberg said over time AI will enable content that it can interact with you. " In the near future, I think that we're going to have content in our feeds that you can interact within that, it will interact back with you rather than you just watching it," he said.

- Zuckerberg expects more productivity caused by AI to enable people to engage more across Meta Platforms apps. "Over the long-term, as AI unlocks more productivity in the economy, I also expect that people will spend more of their time on engaging experiences across all of these apps," he said.

- Zuckerberg pointed out that business messaging in countries like Thailand and Vietnam is high due to the low cost of labor in these countries. He expects business AI agents to reduce the cost of labor in developed countries, hence increasing their adoption.

- Zuckerberg said their focus this year is making Meta AI a leading personal AI by emphasizing personalization, voice conversations, and entertainment. "I think that we're all going to have an AI that we talk to throughout the day, while we're browsing content on our phones, and eventually, as we're going through our days with glasses. And I think that this is going to be one of the most important and valuable services that has ever been created," he said.

- Zuckerberg said over time, he sees monetization opportunities in Meta such as showing ads and offering a premium service to people who want more compute. However, over they next year, they will focus on deepening its engagement and usage. " I think that there will be a large opportunity to show product recommendations or ads, as well as a premium service for people who want to unlock more compute for additional functionality or intelligence. But I expect that we're going to be largely focused on scaling and deepening engagement for at least the next year, before we'll really be ready to start building out the business here," he said.

- Zuckerberg said sales of Ray-Ban Meta glasses have tripled in the last year.

AI agents

- Zuckerberg said the timing of when the expect the mid-level engineer to arrive hasn't changed. "So I'd say, it's basically still on track for something around a mid-level engineer, kind of starting to become possible sometime this year, scaling into next year. So I'd expect that by the middle to end of next year, AI coding agents are going to be doing a substantial part of AI research and development. So, we're focused on that." (Q&A).

- Li said they are currently testing business AI agents with a small set of businesses in the US and a few other countries in WhatsApp and Messenger, and on ads in Facebook and Instagram (Q&A).

- Li said they have launched a new agent management experience and dashboard that makes it easier for businesses to train AI based on existing information in their WhatsApp profile and Facebook and Instagram pages, and they are starting with AI chat agents (Q&A).

- They are also testing AI agents on Facebook and AI ads that help customers with purchase and return policies (Q&A).

- Li said they are hearing encouraging feedback from businesses (Q&A).

- Zuckerberg said internally, they are focused on building AI agents that run different experiments to increase the ad recommendations (Q&A).

Ad recommendation system

- Li said they are testing how to integrate LLMs in their ad recommendation system. They began testing it with Threads at the end of last year and they have seen a 4% increase in time spent from the first launch. She said they expect this to be complimentary to their personalization efforts in Meta AI.

- Li said GEM is twice as efficient in improving ads performance. She reiterated that their test in Facebook Reels this year resulted in a 5% increase in ads recommendations.

- Li said their incremental attribution feature, which drive results that are optimized for each business's objectives has resulted in a 46% increase in conversions.

Q1 2025 results

- Li said online commerce verticals was the biggest contributor to year-over-year growth in ad revenue.

- Ad revenue growth was strongest in Rest of World (+19%), followed by North America (+18%), Europe (+14%) and then Asia-Pacific (+12%).

- Li said ad pricing during the quarter benefited from increased advertiser demand, in part driven by strength in ad performance but offset by impression growth, particularly in lower monetizing regions.

- Family of App's other revenue which rose 34% y/y to $510 million was driven by messaging revenue growth from WhatsApp business and payment for verified subscription.

- Li said they saw healthy growth in most verticals in Q1. However, they did see a year-over-year decline in gaming vertical (due to lapping of strong comps by China-based advertisers) and a sharp drop in politics vertical (due to end of US elections).

- Tax rate for the quarter was 9% . Meta recognized excess tax benefits due to appreciation in the share price.

- G&A fell 34% y/y due to reduced legal-related costs.

- Marketing and sales increased by 8% y/y driven by "an increase in professional services related to our ongoing platform integrity efforts."

Family of Apps

Family of Apps usage

- Zuckerberg said Threads now has 350 million monthly actives.

- Zuckerberg said business messaging should be the next pillar of their business. He said WhatsApp now has 3 billion monthly actives and 100 million users in the U.S and growing quickly there. Messenger is now used by more than a billion people.

- Zuckerberg said in the last six months, improvements in the ads recommendations have led to a 7% increase in time spent on Facebook, a 6% increase on Instagram, and 35% on Threads.

- Li said in Q1, they saw strong growth in video consumption in Facebook and Instagram, particularly in the U.S where video time spend grew double digits y/y.

- Li said Ray-Ban Meta glasses has 4 times as many monthly actives as a year ago.

Family of Apps product launches

- Li said they launched an Instagram Feed in Q1 that has content your friends have left a note on or liked, and they are seeing good results with it.

- Li said they recently launched Blend in Instagram, which enables you to blend your Reels algorithm with that of your friends and spark more meaningful conversations.

- Li said last week they launched a standalone Edits app, that has an ultra-high resolution short-form video camera and Gen AI tools that enable you remove any background of any video and animate still images.

- Li said they started opening up Threads to more ads this month. She said they don't expect Threads to be a meaningful driver of their overall revenue in 2025.

Reality Labs

- Asked whether there is light at the end of the tunnel when it comes to Reality Labs losses, Zuckerberg suggested that they could be an opportunity once the products reach their third generation. "If you look at the -- some of the leading consumer electronics products of other categories, by the time they get to their third generation, they're often selling 10 million units and scaling from there and I'm not sure if we're going to do exactly that, but I think that that's like the ballpark of the opportunity that we have and that's something that I think we're kind of focused on scaling to that and then scaling beyond that for the generations after that."(Q&A)

- Zuckerberg pointed out that they are focused on doing the work efficiently and that they are optimistic with what they are seeing in the results especially in the AI glasses.

Management expectations and analysts estimates

Management Guidance

| Key Items[1] | Q1 2025 | 2025[1] | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Lower-point | Y/Y | Mid-point | Y/Y | Upper-point | Y/Y | Lower-point | Y/Y | Mid-point | Y/Y | Upper-point | Y/Y | |

| Revenue | $39.5 billion | 8.4% | $40.7 billion | 11.6% | $41.8 billion | 14.7% | ||||||

| Total expenses | $114.0 billion | 19.8% | $116.5 billion | 22.5% | $119.0 billion | 25.1% | ||||||

| Capital expenditure | $60.0 billion | 52.9% | $62.5 billion | 59.3% | $65.0 billion | 65.7% | ||||||

- Management's guidance assumes foreign exchange headwind will be 3%.

- Management expects full year tax rate to be in the range of 12-15%.

Analysts estimates

| Key Items | Q1 2025 | Y/Y | Q2 2025 | Y/Y | 2025 | Y/Y |

|---|---|---|---|---|---|---|

| Revenue[2] | $41.37 billion | 13.48% | $44.05 billion | 12.75% | $186.35 billion | 13.25% |

| EPS[2] | $5.23 | 11.04% | $5.63 | 9.10% | $24.74 | 3.68% |

| Family Daily Active People[3] | 3.38 billion | 4.4% | ||||

| Ad revenue[3] | $40.4 billion | 13.3% | ||||

| Capex[4] | $14.32 billion | 113% | ||||

| Revenue- Reality Labs[5] | $496 million | |||||

| Reality Labs operating loss[5] | $4.21 billion | |||||

| Operating margin[5] | 37.5% | |||||

| Ad impressions[5] | 7% | |||||

| Average price per ad[5] | 7% |

Earnings revisions at Seeking Alpha in the last three months

- Q1 2025 revenue and EPS estimates have been stable in the past three months.

- Analysts have lowered Q2 2025 revenue estimate by around 2% and EPS estimate by around 3% in the last three months.

- Analysts have lowered 2025 revenue estimate by around 1% and EPS estimate by around 2% in the last three months.

Analysts opinions and insights

Ad checks in Q1 were largely positive for Meta

- Overweight, $775->$610: Piper Sandler said their checks with an Ad Buyer were considered the best in the group.

- Evercore said said their ad checks indicate fairly stable ad demand environment across most channels. They added that channel checks on ad demand and ROAS trends were positive for Meta.

- Overweight, $790->$624: Analyst Deepak Mathivanan of Cantor Fitzgerald said said they noticed a slight slowdown in March, but this will be offset by favorable foreign exchange rates.

- Cavenagh Research said their checks with six marketing professionals, each managing more than $1 million quarterly ad spend indicates Meta continues to capture outsized marketing spend in the US. It pointed out that advertisers reported strong tailwinds in Q4 have continued into Q1. Four of the seven spenders noted ad spend grew 5%-10%, one saw growth of 10% while two saw flat growth.

- Needham said their ad checks indicate Meta’s ROAS for many clients has gone down below its historical level of 1.80x. They noted that SMBs have been moving money out of Meta into higher ROAS alternatives such as performance-CTV, with yields of 2.5-4.0x.

- Buy, $750->$675: Guggenheim expects Meta's Q1 2025 advertising revenue to come in above management's upper guidance of $39.8-$41.8 billion.

User engagement in Facebook and Instagram continues to grow

- Guggenheim expects said Apptopia data indicates robust user engagement in Facebook and Instagram. It indicates that Facebook's user time grew 9.3%, an improvement from 6.5% in Q4, while Instagram witnessed a 5.9% growth, recovering from a 1.0% decline.

Meta will likely top management guidance in Q1

- Outperform, $730->$640: Wolfe Research expects Meta's Q1 2025 revenue will hit the upper-end of the management guidance and align with consensus estimates due to conservative prior guidance and a slight improvement in foreign exchange rates.

- Evercore said they view the street's Q1 revenue estimates of +14% y/y as reasonable.

- Analyst Deepak Mathivanan of Cantor Fitzgerald said Meta's Q1 earnings will likely align with the company's high-end guidance.

Meta might miss Q1 earnings estimates

- Needham said they expect Meta's Q1 revenue and adjusted EPS to come in at $40.60 billion and $4.82, below the consensus estimate of $41.36 billion and $5.24 billion respectively.

Q2 and 2025 guidance will likely be weak due to tariff pressure on ad spend

- Wolfe Research expects Meta will guide Q2 revenue at a low single-digit percentage, below consensus estimate of $41.5 billion- $44 billion. Wolfe said they lowered their 2025 estimates by 1.5% to 2.0%.

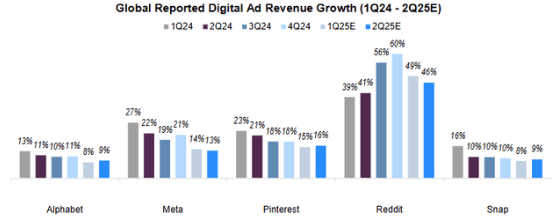

- Guggenheim said they revised their industry-wide ad demand growth projection for 2025 to 12.5% from 15.1% due to anticipated deceleration in the sector.

- Piper Sandler said the focus is now on Q2 guidance, where it expects revenue in the range of $42.5 billion and $45.5 billion (9-16.5%). Piper Sandler pointed out that they lowered their revenue estimate for 2025 and 2026 by 2% and 4% respectively, due to exposure to China.

- Overweight, $710->$645: keyBanc said their ad checks are deteriorating, with budget growth expectations now landing in the 3%-5% range. Although they expect digital ad spend to outpace the market by 2-3 turns, they are incrementally cautious that ripple effects on supply chains and consumer spending could impact margins and EPS.

- Buy, $765->$640: Bofa said channel checks conducted in mid-March indicate pressure on ad spending will materialize due to the negative headlines and the latest tariff announcements. Bofa lowered 2025 ad spend estimates by about 4%. They lowered Meta's 2025 and 2026 revenues by roughly 4% and EPS estimates by 5%-7% due to deeper ad auctions, higher mix of direct ad response and 2%-3% foreign exchange benefit.

- Cantor Fitzgerald said Q2 guidance may not meet consensus at the higher range, which is expected to be $44.4 billion (+14% y/y). The guidance considers the company's exposure to the tariffs. They project Q2 revenue growth of 9% and second-half revenue growth of 7% y/y.

- Buy, $770->$700: Truist expects Meta's management to guide for Q2 2025 revenue in the range of $41.5 billion to $44 billion (+6%-13%).

Chinese advertisers have cut ad spend

- Citing the Information and Search Engine Land, Mizuho pointed out that Chinese advertisers have reduced their ad spend due to the tariffs.

- Buy, $710->$525: MoffettNathanson said Meta's financial performance could be materially hit this year as Chinese advertisers pull back marketing spend due to escalating U.S.-China trade tensions. The analysts added that the end of de minimis rule, which allowed goods below a certain threshold value to enter the U.S. could impact Chinese advertiser demand on Meta Platforms. They added that Temu and Shein were responsible for the spike in Meta's ad dollars in 2023. They added that cost-cutting measures are unlikely to absorb the hit. It estimates that Meta could lose $7 billion revenue this year due to the tariffs.

Meta is likely to reiterate its 2025 opex and capex guidance

- Cantor Fitzgerald expects Meta to reiterate its full-year operating expenses and capital expenditure.

- Truist expects Meta to maintain its opex and capex guidance for the full year.

- Piper Sandler expects management to reiterate its operating expenses for 2025 ($114-$119 billion), alongside capex at $60-$65 billion.

- Needham doesn't expect Meta to cut its capex guidance for 2025 since Gen AI is an essential 10-year investment.

Competitor results and expectations

Alphabet

Analysts expectations

- According to Visible Alpha, overall expectations for Alphabet's Q2 results have not changed much. Here are the analysts expectations.

| Key Metrics in millions | Q1 2025 | Y/Y | Q2 2025 | Y/Y |

|---|---|---|---|---|

| Revenue | $89,228 | 11% | $93,591 | 10% |

| Google Search revenue | $50,418 | 9% | $52,715 | 9% |

| YouTube revenue | $8,953 | 11% | $9,603 | 11% |

| Cloud revenue | $12,270 | 28% | $13,170 | 27% |

| Operating profit margin | 32% | 33% | ||

| Diluted EPS | $2.01 | $2.14 |

Advertising spend and pricing insights

Revealbot data indicates that Meta Platforms CPM rose sharply during the quarter

- Birch (formely Revealbot) data indicates that Instagram CPM rose by around 34.5% y/y to $13.4.

- Similarly, the data indicates that Facebook CPM was up by around 47.2% to $13.25.

References

- ↑ 1.0 1.1 https://investor.atmeta.com/investor-news/press-release-details/2025/Meta-Reports-Fourth-Quarter-and-Full-Year-2024-Results/default.aspx

- ↑ 2.0 2.1 https://finance.yahoo.com/quote/META/analysis/

- ↑ 3.0 3.1 https://www.ig.com/uk/news-and-trade-ideas/meta-platforms_-1q-earnings-preview--what-to-expect-250423#:~:text=Meta's%20Q1%202025%20revenue%20is,growth%20recorded%20in%20Q4%202024.

- ↑ https://www.cnbc.com/2025/04/30/meta-q1-earnings-report-2025.html?taid=68124c0c8ac6120001256029&utm_campaign=trueanthem&utm_content=main&utm_medium=social&utm_source=twitter

- ↑ 5.0 5.1 5.2 5.3 5.4 https://www.smartkarma.com/home/newswire/earnings-alerts/meta-platforms-facebook-meta-earnings-exceed-expectations-with-strong-q1-revenue-growth/